🌟 Editor's Note

I’m but a lone human writing this blog with occasional editorial help, I spent over a week scouring clinicaltrials.gov and various pharmaceutical companies pipelines and clinical trial pages. If I missed a trial or particular molecule, just know I did my best!

My last post was extremely heavy on the science of kidney disease and physiology. This post will be a bit more of a breezy (but 6000 words!) update on what 2026 is going to bring in terms of clinical trial results from various incretins along with my personal thoughts on each drug and an arbitrary rating system for how exciting a particular molecule is. Most will be GLP-1 based, but Amylin is currently the hot topic in the weight loss space because it may have better tolerability and less side effects. I am going to start with the smaller, lesser-known drugs and companies, as Eli Lilly and Novo Nordisk continue to dominate this landscape in 2026, so in my opinion they can until the end.

Rating system:

1/10- Nothing new, toss it in the pile for later

3/10- Slight eyebrow raise, needs data to prove itself worthy

5/10- Phase 1 & 2 data is competitive, and/or novel mechanism

7/10- Best in class possible? Novel or new FDA indications

10/10- Completely alters our perception of what is possible in medicine

Amgen

Amgen is traditional big pharma company with a particular molecule that I’ve discussed before, MariTide, which is a GIP antagonist monoclonal antibody with a GLP-1 receptor agonist attached to it. Initial phase 2 data was presented in the summer of 2025, which showed impressive weight loss but significant side effects.

These two studies further look into its efficacy, with one trial being for Type 2 diabetics, first for an initial 24-week study, which can then be extended up to a 72-week trial if patients meet certain criteria. This trial should be finished in November 2026 so we may not get topline results until 2027.

The second trial looks at obese non-diabetics and obese diabetics. Both will be treated for 52 weeks with MariTide and then extended out for maintenance dosing, but Amgen doesn’t get into specifics for how long. This trial is supposed to finish in January 2026, so expect topline data release in the first few months of 2026.

The only thing that is really interesting here is the maintenance trial, does lowering the dose prevent weight regain? The diabetics only trial may or may not add new information. The novel once monthly dosing is intriguing, but the high rate of initial side effects still needs to show improvement. I’ll give this 5/10 on the excitement scale.

Study Details | NCT06660173 | A Study of Maridebart Cafraglutide in Adult Participants With Type 2 Diabetes Mellitus (T2DM) | ClinicalTrials.gov

Study Details | NCT05669599 | Dose-ranging Study to Evaluate the Efficacy, Safety, and Tolerability of AMG 133 in Adult Subjects With Overweight or Obesity, With or Without Type 2 Diabetes Mellitus | ClinicalTrials.gov

Editor’s Note: Amgen released a statement saying maintenance dosing showed continued weight loss/weight stability but hasn’t actually released any further details.

Altimmune

Altimmune on the other hand is the opposite of a big company. They’re a small startup with a single asset. Their drug is called Pemvidutide and it’s a GLP-1/Glucagon agonist. Perhaps recognizing the headwinds they face, Altimmune has focused more on the liver benefits of their drug and is seeking novel indications. This particular trial is set to finish in summer 2026 and it is to see if Pemvidutide is beneficial in Alcohol Use Disorder. This is one of the first formal randomized clinical trials of a GLP-1 medicine for substance use issues. While the drug itself doesn’t cause massive weight loss, the idea that it might be beneficial in substance use means this gets a 7/10 from me as given the paucity of treatments for substance use disorders.

Study Details | NCT06987513 | RECLAIM STUDY: A Phase 2 Evaluating the Efficacy and Safety of Pemvidutide in the Treatment of Alcohol Use Disorder (AUD) in Subjects With Obesity or Overweight | ClinicalTrials.gov

AstraZeneca

Back to the land of big pharma, we have a new player, but old player to the obesity market. Astrazeneca technically owned the rights to the very first GLP-1 medication, exenatide and stopped making it in 2024. Since then, they’ve started to dabble their toes back in the waters. They have 3 particular drugs that all will report out in 2026. The first is AZD5004, an oral small molecule GLP-1 agonist that is so similar in chemical structure to orforglipron, I’m shocked Eli Lilly didn’t sue for patent infringement. Both these trials should report out in the next month or two. Excitement level is 1/10. We know what orforglipron can do, this is just a ‘me too drug.’ Sorry AZ. That’s the truth.

They’re all so similar!

Study Details | NCT06579105 | Efficacy, Safety, and Tolerability of Once Daily Oral Administration of AZD5004 Versus Placebo for 26 Weeks in Adults With Type 2 Diabetes Mellitus. | ClinicalTrials.gov

Study Details | NCT06579092 | Effects of AZD5004 in Adults Who Are Living With Obesity or Overweight With at Least 1 Weight-related Comorbidity | ClinicalTrials.gov

If AZD 5004 is a copy of orforglipron, then AZD 6234 is similar to Eloralintide. It's a selective amylin agonist, with reduced calcitonin receptor activity. Without going too much deeper, this is probably the better way to design an amylin agonist, as the calcitonin receptor seems to be responsible for many of the side effects seen with cagrilintide without much extra weight loss. That being said, the initial phase 1 trial will finish in March, which is a 1/10 rating for sure, but the fascinating trial wraps a little later in the year. It tests AZD6234 as an adjunct to patients already on an approved GLP-1 drug. That’s a fun way to see what your drug can do, and if it can add further weight loss and A1c control. I’ll give that one 3/10 for novel trial design.

Study Details | NCT06132841 | A Study to Assess the Safety, Tolerability, Pharmacokinetics, and Pharmacodynamics of AZD6234 After Repeat Dose Administration in Participants Who Are Overweight or Obese | ClinicalTrials.gov

Study Details | NCT06851858 | Efficacy, Safety and Tolerability of AZD6234 in Participants Living With Overweight or Obesity With Type 2 Diabetes Who Are on a Stable Dose of GLP-1 Receptor Agonist | ClinicalTrials.gov

The last molecule from AZ is probably the most mysterious at this point in time. AZD9550 is a dual GLP-1/Glucagon receptor agonist, but beyond that I cannot give you characteristics, potency or really anything. All I can report is that there are two trials, one in diabetics and one in non-diabetics. Both are testing AZD9550 as a monotherapy AND as a combined therapy with AZD6234. The first trial results should be reported out in the summer. This is the first and only trial I’m aware of testing GLP-1/Glucagon AND amylin simultaneously. I’ll be curious to see the tolerability and if there is synergistic weight loss. This article is massive with numerous drugs, but this has a potential to be a surprise result in 2026. Those facts alone get it to a 5/10 from me.

Study Details | NCT06862791 | A Weight Loss Study Evaluating Subcutaneous Treatment With AZD9550 and AZD6234 in Combination Against Placebo or Each of the Drugs Alone | ClinicalTrials.gov

Study Details | NCT06151964 | A Trial to Learn How Safe AZD9550 Monotherapy and Combined With AZD6234 is in People With or Without Type 2 Diabetes Who Are Living With Obesity and Overweight | ClinicalTrials.gov

Structure

Moving back to the world of start-up companies we have Structure with Aleniglipron, they had a preliminary read out of data at Obesity Week 2025 which showed better weight loss efficacy than orforglipron. This set the stock on fire, and now the question is whether some Big Pharma company will buy them out. But I’m here to pump the brakes a little bit, because while it is true that Structure has these three trials all reporting out this year, I’m not sure we’ll actually learn anything new. It’s a mono-agonist GLP-1 non-peptide drug it does have seemingly better weight than orforglipron, therefore toss it in the pile with all the others at this point, 4/10.

Study Details | NCT06693843 | A Phase 2b, Dose-range Finding Study of the Efficacy and Safety of Multiple Doses of Aleniglipron (GSBR-1290) in Participants Living With Obesity or Overweight With at Least One Weight-related Comorbidity | ClinicalTrials.gov

Study Details | NCT06703021 | A Dose-Range Study of Aleniglipron (GSBR-1290) in Participants Living With Obesity or Overweight With at Least One Weight-related Comorbidity | ClinicalTrials.gov

Metsera/Pfizer

Metsera is now owned by Pfizer after an awkward back and forth bidding war in late 2025 between Pfizer and Novo. Ultimately Pfizer won. What they got was a mono-agonist GLP-1 that can be dosed monthly or weekly. They also have MET-233 which is a monthly amylin agonist. We’ve already discussed some of the findings on this blog for MET-097i as it was presented at ObesityWeek 2025, that trial showed about 14% weight loss at 28 weeks, but it was also extended for a longer duration. That particular extension trial will report out in 2026. In addition, we get VESPER-2 which is in diabetics with MET-097i. We’ll also get results from MET-233 combined with MET-097 and VESPER-3 the first trial of monthly dosing of MET-097. The weight loss is on par with semaglutide, the side effects are seemingly lower, and the idea of monthly dosing is intriguing, so 5/10. But also, personal opinion, Pfizer probably overpaid for these assets, as they look to be easily lapped by multiple other drugs in terms of efficacy before ever getting to market.

Study Details | NCT06973720 | A Phase 2b Study to Evaluate the Efficacy and Safety of Once-Monthly MET097 in Adults With Obesity or Overweight | ClinicalTrials.gov

Study Details | NCT06924320 | A Study of MET233 in Combination With MET097 in Individuals With Obesity or Overweight With or Without Diabetes | ClinicalTrials.gov

Study Details | NCT06897202 | A Study to Evaluate the Efficacy and Safety of Once-Weekly MET097 in Adults With Obesity or Overweight and T2DM | ClinicalTrials.gov

Study Details | NCT06712836 | A Phase 2b Study to Examine the Safety and Efficacy of Once-Weekly MET097 in Adults With Obesity or Overweight | ClinicalTrials.gov

Roche/Carmot

Here’s a company and drug I’ve never mentioned on this blog, Roche. They’re yet another player trying to break into the obesity space. They have two particular molecules in development, the first is CT-388 which is GIP/GLP-1 dual agonist. Earlier trials showed impressive weight loss, up to 18% but there were concerns about tolerability as the rates of side effects were truly quite high and the drug has short half-life. The obesity trial of CT-388 actually finished in December 2025 so we should have results anytime now. The diabetes trial will report out later in the year, however, the obesity trial will honestly make or break this molecule. 6/10 as it’s either going to boom or bust.

The other molecule in development is Petrelintide, which is being co-developed with Zealand Pharma. This is a dual amylin calcitonin agonist and early phase 1 data showed about 8.5% weight loss at 16 weeks(similar weight loss trajectory as 2.4mg of semaglutide) with very low rate of side effects, however, that was also a very small trial. Both the obesity and diabetes trials will be 42 weeks long with many more patients. Same as CT-388 this could be boom or bust, depending on the results 6/10.

Study Details | NCT06525935 | A Study of CT-388 in Participants With Obesity or Overweight With at Least One Weight-Related Comorbidity | ClinicalTrials.gov

NCT06628362 | A Study of CT-388 in Participants Who Are Overweight or Obese With Type 2 Diabetes Mellitus | ClinicalTrials.gov

Study Details | NCT06662539 | Once-weekly Petrelintide Versus Placebo for Obesity or Overweight With Co-morbidities | ClinicalTrials.gov

Study Details | NCT06926842 | Efficacy and Safety of Petrelintide in Participants With Overweight or Obesity and Type 2 Diabetes (ZUPREME 2) | ClinicalTrials.gov

Boehringer-Ingelheim

I’ll be honest, I wrote this article in such a way as to save the meat and potatoes for the end, which essentially starts here. Everything else so far is essentially nowhere near FDA approval. Starting here with Survodutide and continuing on with Novo and Eli Lilly we’ve got drugs that are already FDA approved or less than a year away from that. If there is any chance of breaking the duopoly that Eli Lilly and Novo Nordisk have created, it’s going to come from Survodutide. No pressure Boehringer Ingelheim! The only other drug that has that potential is VK2735 and that’s not going to be FDA approved until 2028 at the earliest. Survodutide could be approved by early 2027.

Survodutide is a dual GLP-1/Glucagon agonist and phase 2 data was actually impressive, nearly 19% weight loss at 46 weeks with no plateau at the 4.8mg dose, but the problem was actually side effects. The pooled tolerability of Survodutide in phase 2 was similar to semaglutide, but the higher doses had consistently higher rates of nausea and a slightly higher rate of vomiting. Part of this reason was a novel, but rapid 2 week titration scheme. They’ve fixed that in phase 3, allowing anti-emetic use as needed and extended dose titration to a whopping 32 weeks! For reference the longest dose titration on the market right now is tirzepatide at 20 weeks.

Still dropping at 46 weeks!

Diabetes also lost plenty of weight in 16 weeks and excellent A1 reductions

With all that pretext, the first Survodutide data is due anytime in the next month or two. The phase 3 trial for NASH/MASLD is done, the obesity trial finishes in early February, and the diabetes trial wraps in April. Data from these trials will be presented at ADA 2026 conference. Their very large CVOT trial finishes in the summer. Expectations are 20-25% weight loss which would match Tirzepatide and CagriSema. In addition, expect to see large reductions in cholesterol and triglycerides from the glucagon agonism, and possibly some renal benefits as well. This is easily an 8/10 for me, but also if the side effects remain an issue, it could chill expectations. I’m hoping otherwise, as we sorely need other options.

Study Details | NCT06309992 | A Study to Test Whether Survodutide Helps People Living With Obesity or Overweight and With a Confirmed or Presumed Liver Disease Called Non-alcoholic Steatohepatitis (NASH) to Reduce Liver Fat and to Lose Weight | ClinicalTrials.gov

Study Details | NCT06077864 | A Study to Test the Effect of Survodutide (BI 456906) on Cardiovascular Safety in People With Overweight or Obesity (SYNCHRONIZE™ - CVOT) | ClinicalTrials.gov

Study Details | NCT06066528 | A Study to Test Whether Survodutide (BI 456906) Helps People Living With Overweight or Obesity Who Also Have Diabetes to Lose Weight | ClinicalTrials.gov

Study Details | NCT06066515 | A Study to Test Whether Survodutide (BI 456906) Helps People Living With Overweight or Obesity Who do Not Have Diabetes to Lose Weight | ClinicalTrials.gov

Novo Nordisk

Now we get into the duopoly, and yes, I’m saving Eli Lilly for last because their 2026 pipeline is so massive that I could have written an entire separate article just for them. Meanwhile, Novo Nordisk had an eventful 2025 where their stock price was demolished for various reasons, including their CEO being fired and Lilly’s wild success with tirzepatide. Another reason for the stock decline in 2025 was the initial CagriSema results which did not show the amount of weight loss that some were expecting and questions about side effects. They also, despite being a public company, make it exceedingly difficult to find their active trials. Well, I can tell you 2026 is basically ALL CAGRISEMA from Novo.

The rest of their 2026 development pipeline is essentially barebones, stuck in phase 1/phase 2. So let’s review that really quickly. There are 2 GLP1/GIP/Glucagon triple agonists in development, one of which is UBT251. We’ll get readouts on UBT251 this summer, the other we probably won’t hear anything until January 2027. Then they have a selective amylin agonist, and another DACRA. Amycretin has nothing reporting out this year(and the tolerability is frankly, bad.) The 2 triple agonists could challenge retatrutide, but they’re years away and we have essentially zero data on any of this stuff. 3/10 for the two triple agonists, 1/10 for the two amylin assets.

Study Details | NCT07177469 | UBT251 Injection Phase II Study (Overweight or Obesity) | ClinicalTrials.gov

Study Details | NCT07163624 | UBT251 Injection Phase II (Type 2 Diabetes Mellitus) Study | ClinicalTrials.gov

Study Details | NCT06719011 | A Study on How NNC0174-1213 Works in People With Overweight or Obesity. | ClinicalTrials.gov (selective amylin agonist)

Study Details | NCT06577766 | A Research Study on How NNC0638-0355, a New Medicine, Works in People Living With Overweight or Obesity | ClinicalTrials.gov (amylin)

Moving on to CagriSema, I’ll be blunt, a few of these trials will flat out make or break Novo this year independent of anything that Eli Lilly does. High on that list is REDEFINE 4 & REIMAGINE 4. The first is a trial testing CagriSema against Tirzepatide in obesity, and the other is the same thing but for diabetes. Novo actually extended REDEFINE 4 to 84 weeks from the original 72 weeks as it sounds like they think that by doing so they’ll be able to show superior weight loss to Tirzepatide.

It is ominous that they had to do that, as that suggests there was no difference in weight loss at week 72 between the two drugs.

We know less about REIMAGINE 4 but based on earlier results that trial is unlikely to show CagriSema as superior to Tirzepatide in diabetes as well. REDEFINE 4 wraps up in January 2026 and the REIMAGINE a few months later. If either trial isn’t a massive win for CagriSema then it might be rough seas for Novo.

That being said, as you can see there’s a ton of CagriSema trials reporting out this year, including testing lower doses. These various trials I’ll give an 8/10 we’ll learn more about CagriSema, it’s an important development in the incretin space and advances our knowledge of amylin analogs that much further.

The last 4 on the list are the most interesting and novel. One looks to see if CagriSema can reduce diabetic neuropathy pain, one to test the insulin effects of CagriSema, one trial of kidney function/renal outcomes, and one trial testing CagriSema with zalfermin, an FGF21 analog in patients with liver disease. These trials may even warrant separate blog posts if Novo is generous in the data presentations of them, easily a 9/10 given the novelty and new knowledge gained, as I genuinely do not know what to expect from any of them at this point, and these trials could save Novo for 2026, or at least give them a way to differentiate themselves from Tirzepatide.

Study Details | NCT06131437 | A Research Study to See How Well CagriSema Compared to Tirzepatide Helps People With Obesity Lose Weight | ClinicalTrials.gov REDEFINE 4

Study Details | NCT06388187 | A Research Study to See How Well Different Doses of CagriSema Help People With Excess Body Weight Lose Weight | ClinicalTrials.gov (CagriSema 1.0/1.0 and 1.7/1.7 dose, REDEFINE-9)

Study Details | NCT06323174 | A Research Study to See How Much CagriSema Lowers Blood Sugar and Body Weight Compared to Placebo in People With Type 2 Diabetes Treated With Diet and Exercise | ClinicalTrials.gov (REIMAGINE 1)

Study Details | NCT06065540 | A Research Study to See How Well CagriSema Compared to Semaglutide, Cagrilintide and Placebo Lowers Blood Sugar and Body Weight in People With Type 2 Diabetes Treated With Metformin With or Without an SGLT2 Inhibitor | ClinicalTrials.gov (REIMAGINE 2)

Study Details | NCT06323161 | A Research Study to See How Much CagriSema Lowers Blood Sugar and Body Weight Compared to Placebo in People With Type 2 Diabetes Treated With Once-daily Basal Insulin With or Without Metformin | ClinicalTrials.gov (REIMAGINE 3)

Study Details | NCT06221969 | A Research Study to See How Much CagriSema Lowers Blood Sugar and Body Weight Compared to Tirzepatide in People With Type 2 Diabetes Treated With Metformin With or Without an SGLT2 Inhibitor | ClinicalTrials.gov (REIMAGINE 4)

Study Details | NCT06534411 | A Research Study to See How Much CagriSema Lowers Blood Sugar and Body Weight Compared to Tirzepatide in People With Type 2 Diabetes Treated With Metformin, SGLT2 Inhibitor or Both | ClinicalTrials.gov (REIMAGINE 5)

Study Details | NCT06797869 | A Research Study to Investigate the Effects of CagriSema Compared to Placebo in People With Type 2 Diabetes and Painful Diabetic Peripheral Neuropathy | ClinicalTrials.gov

Study Details | NCT06403761 | Investigating How CagriSema, Semaglutide and Cagrilintide Regulate Insulin Effects in the Body of People With Type 2 Diabetes | ClinicalTrials.gov

Study Details | NCT06131372 | A Research Study to See if Kidney Damage in People With Chronic Kidney Disease and Type 2 Diabetes Living With Overweight or Obesity Can be Reduced by CagriSema Compared to Semaglutide, Cagrilintide and Placebo | ClinicalTrials.gov

Study Details | NCT06409130 | Effects of NNC0194-0499, Cagrilintide, and Semaglutide Alone or in Combinations on Liver Damage and Alcohol Use in People With Alcohol-related Liver Disease | ClinicalTrials.gov

Congratulations if you made it this far, this light and breezy post turned out pretty long winded. Apparently weight loss is popular. Who knew?! So now on the current biggest player on the GLP-1 street.

Eli Lilly

We’ll start with the early stage and lesser-known molecules, then finish with their two big players.

Well, actually, orforglipron is well known at this point, it should be FDA approved in a few months, but this trial is pivotal for its use as a diabetes drug. ACHIEVE-4 is the 2 year CVOT/MACE trial that is required by the FDA. While we know what orforglipron can do, we have no idea if the cardiovascular benefits of a small molecule GLP-1 medication match that of injectable drugs. This trial will prove, or disprove this notion. For that alone this is an 8/10 as if it has the same effects as injectables on reducing cardiovascular risk, it’ll be a huge deal. Full data read out is expected at ADA 2026.

NCT05803421 | A Study of Daily Oral Orforglipron (LY3502970) Compared With Insulin Glargine in Participants With Type 2 Diabetes and Obesity or Overweight at Increased Cardiovascular Risk | ClinicalTrials.gov (ACHIEVE-4)

Brenipatide.

This is a molecule you should expect to hear about ALOT in 2027/2028, it’s a dual GIP/GLP-1 agonist. Structurally, it’s looks like tirzepatide and retatrutide had a baby but deleted the glucagon agonism. Lilly is claiming it’ll be their ‘neurological indications’ drug. This trial is the initial phase 1 trial looking at tolerability, weight loss etc. We may not even get this data published simply because Lilly already has FIVE phase 2 or 3 trials of this drug targeting smoking cessation, alcohol use, asthma and bipolar disorder (!!!) This trial itself isn’t super important as it’s obvious Lilly has good internal data already to be going after such broad indications. But still, this would be a 7/10 if they release this data. They clearly think they have something different here.

NCT06606106 | A Study of LY3537031 in Overweight, Obese, and Healthy Participants | ClinicalTrials.gov

Mazdutide impressed last year with its 20% weight loss in phase 2, but like many molecules had some issues with tolerability at the high doses. Now we get to see if it is effective as a treatment for alcohol use disorder. I gave pemvidutide a 7/10 and that feels appropriate here as well, mazdutide causes much more weight loss, but the real key here is can it stop folks from drinking?

Study Details | NCT06817356 | A Study to Evaluate Mazdutide Compared With Placebo in Participants With Alcohol Use Disorder | ClinicalTrials.gov

I’ll be honest these next two trials have my excitement meter pegged off scale 10/10 no questions asked. These combine eloralintide with tirzepatide. Both drugs show excellent weight loss alone, 15-20% for each individually and good to great tolerability. This combo could potentially match retatrutide for weight loss and absolutely wreck anything Novo’s thought they had with CagriSema. The obesity trial is done and will report out anytime. The diabetes trial will be later in the summer. I’m expecting some pretty crazy results from these two trials even though they’re somewhat shorter in length.

Study Details | NCT06916065 | A Study of Eloralintide (LY3841136) and Eloralintide With Tirzepatide in Participants With Overweight or Obesity | ClinicalTrials.gov

Study Details | NCT06603571 | A Study to Investigate Weight Management With LY3841136 and Tirzepatide (LY3298176), Alone or in Combination, in Adult Participants With Obesity or Overweight With Type 2 Diabetes | ClinicalTrials.gov

These last 3 I’ll lump together. We have an unknown probably oral GLP-1 med, another oral GLP-1 med which is the apparently tweaked version of orforglipron called Naperiglipron(who thinks of these dang names?!?) and finally the most interesting of the 3, Macupatide which is a mono-agonist GIP agonist for patients with obesity. We know GIP alone can cause a little bit of weight loss in diabetics, but we’ve never seen a 20-week study in obese patients, and I’m not sure what Lilly’s goal is with this drug. However, I do know they’re studying it as a combo drug with Eloralintide, with data for that expected in 2027. I’ll give this a 5/10. Not expecting anything crazy from the oral GLP-1 meds but some novelty with the GIP agonist.

Study Details | NCT06945419 | A Study of LY4086940 in Healthy Participants and Participants With Overweight or Obesity, With or Without Type 2 Diabetes | ClinicalTrials.gov (oral unknown?)

Study Details | NCT06557356 | A Study of LY3532226 in Participants With Obesity | ClinicalTrials.gov (Macupatide)

NCT06683508 | A Study to Investigate Weight Management With LY3549492 Compared With Placebo in Adult Participants With Obesity or Overweight | ClinicalTrials.gov (Naperiglipron)

Now for the final two, tirzepatide and retatrutide. You’ve almost made it to the end!

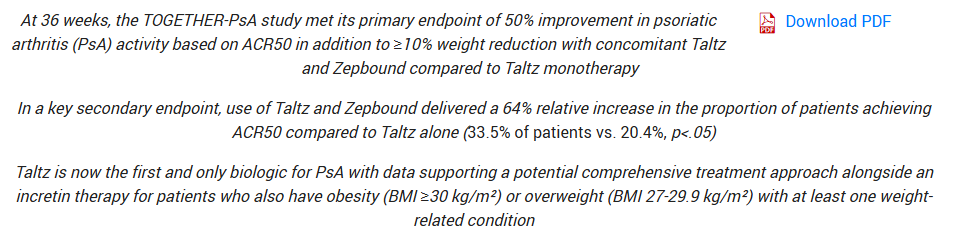

Study Details | NCT06588296 | Ixekizumab Concomitantly Administered With Tirzepatide in Adults With Psoriatic Arthritis and Obesity or Overweight | ClinicalTrials.gov

Dangit Lilly! I was trying to make a preview article and you have to go ahead and spoil the party with these results of tirzepatide and taltz in psoriatic arthritis. I was going to give this trial an 9 out of 10 prior to the results and I was proven correct. Tirzepatide combined with Taltz can significantly improve psoriatic arthritis symptoms in this 36 week trial! That’s incredible. A weight loss drug helping an autoimmune disease.

Incredible. Source: Eli Lilly

Study Details | NCT06588283 | Ixekizumab Concomitantly Administered With Tirzepatide in Adults With Moderate-to-Severe Plaque Psoriasis and Obesity or Overweight | ClinicalTrials.gov

With that being said, another 9/10 for tirzepatide plus Taltz in plaque psoriasis that should wrap in May. Obviously, we’re all expecting it to work again given the initial success. Game changing for autoimmune diseases? It’s possible.

Study Details | NCT06373146 | A Study of Tirzepatide (LY3298176) Plus Mibavademab Compared With Tirzepatide Alone in Adult Participants With Obesity | ClinicalTrials.gov

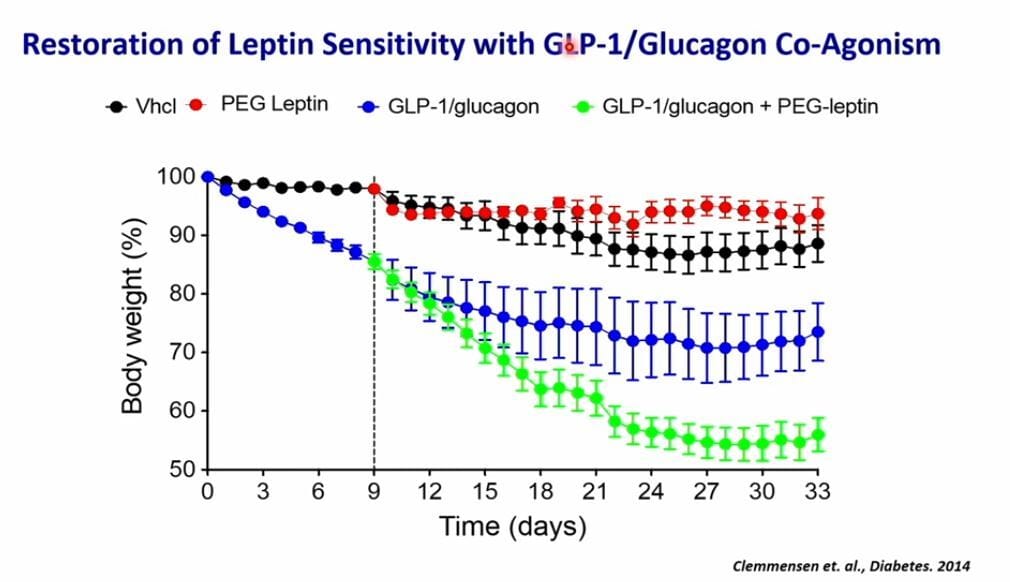

In what is probably another one of my OH MY GOD I NEED THESE RESULTS trials, we have this unassuming trial. It tests tirzepatide with a monoclonal antibody called mibavademab. This particular MAB is special though. It is a leptin receptor agonist. Leptin probably deserves its own article but basically, it’s a hormone deeply involved in appetite, weight, fat storage and long-term weight balance. In 2012 and 2014 Richard DiMarchi and Timo Muller showed that you could combine leptin with GLP-1 or GLP-1/Glucagon dual agonists to have an even greater weight loss while preferentially burning more fat AND preserving lean mass. But that was in rats. Now we get to see if the same holds true in humans. If it does, and it should, this will again approach retatrutide levels of weight loss. The potential is truly massive and makes this an easy 10/10.

So leptin accelerates weight loss in a big way!

Study Details | NCT06643728 | A Study to Investigate Weight Management With Bimagrumab (LY3985863) and Tirzepatide (LY3298176), Alone or in Combination, in Adults With Obesity or Overweight | ClinicalTrials.gov

The next frontier for GLP-1 medications is to avoid lean body mass loss. With that in mind, Lilly acquired a monoclonal antibody called Bimagrumab. Reader’s digest version is this monoclonal antibody can increase lean mass and muscle mass while also burning fat. Early results were promising, EXCEPT, bimagrumab increases LDL cholesterol. We now have a phase 2 trial with tirzepatide, which lowers LDL cholesterol. If the two can cancel each other out in the cholesterol department, we might have a combo of drugs that essentially causes 95-100% fat loss with minimal loss in muscle mass. That could be a big deal, especially for older, more frail patients or sarcopenic obesity patients. 8/10.

Study Details | NCT06047548 | A Study of LY3298176 (Tirzepatide) For the Maintenance of Body Weight Reduction in Participants Who Have Obesity or Overweight With Weight-Related Comorbidities | ClinicalTrials.gov

One of the big buzz words in the GLP-1 space is maintenance dosing. We have more and more evidence that these drugs will need lifelong use, as stopping them causes weight regain for the majority of patients and a loss of the cardiometabolic benefits. This particular trial tests maintenance schemes, patients are given tirzepatide for 60 weeks, then maintained on maximum tolerated dose, reduced to 5mg or given placebo for 52 weeks. It should show that for the majority of patients, 5mg as a maintenance dose is effective for tirzepatide. This is sorely needed data, it’s not groundbreaking, but it’s important for prescribers and ultimately for Lilly as they can suggest patients move to a lower dose, saving Lilly some amount of supply/capacity. 7/10

I’d be more excited for this small phase 2 trial looking at tirzepatide and CKD if they weren’t also doing a similar trial for retatrutide that’s massively more important. Still, we know from SURPASS-CVOT trial that tirzepatide is incredibly effective at preserving renal function and this trial will provide insights into why that is, both from MRI studies and blood and urine testing. 8/10, we absolutely need more novel renal trials of GLP-1 medications.

Study Details | NCT06037252 | A Study of Investigational Tirzepatide (LY3298176) Doses in Participants With Type 2 Diabetes and Obesity | ClinicalTrials.gov

Our last tirzepatide study, this one is looking at higher doses of tirzepatide in obese diabetics. Rumor is 20mg and 25mg as the higher doses amounts, which is an absolute monster dose! However, we’ve seen with high dose semaglutide trials, there are some marginal benefits to be gained with higher doses, but also higher side effects. I don’t think you’ll see a difference in A1c, but I suspect you’ll see average weight loss approaching 17-20% in this trial. However, retatrutide should also easily match and exceed that, so I’m not exactly thrilled nor impressed with this particular trial, especially with everything else Lilly has in the pipeline, 4/10.

We’ve arrived at the king of the mountain. Retatrutide is our last stop, and I admit my own bias, since I was a patient in TRIUMPH-1 and lost 30+% of my body weight on the drug. These trials broadly speaking may forever change medicine and how we treat obesity and diabetes. Yes, there are side effects, and yes, those matter, but medicine is an iterative science, and this may open the door to further treatments and discoveries. Triumph 1 is retatrutide and obesity, plus sleep apnea, Triumph 2 is the same thing but with obese diabetics. Triumph 3 is severe obesity (BMI>35) and preexisting cardiovascular disease/shorter duration cardiovascular outcomes trial. It was supposed to be 114 weeks long and was stopped at 88 weeks which usually is a good thing in outcomes trials because it usually means the drug is very effective at preventing the outcomes being measured.

Triumph-1 on the other hand was extended to 104 weeks for about 20% of the patients, including placebo patients who were crossed over and started on the drug! Additionally, if extended, patients went up 12mg or maximum tolerated dose. All of this to say Lilly saw something in their data to suggest that perhaps patients still had weight to lose at 80 weeks. Regardless, expect to see >30% weight loss for Triumph 1 and 3, which matches Roux en Y gastric bypass outcomes! Moreover, in Triumph 2, weight loss should easily clear 20% and probably approach 25% which would be remarkable for diabetics who historically don't lose as much weight on these drugs. These 3 trials are basically an 11/10 they're going to come as a shock to the medical world.

Study Details | NCT05929066 | A Study of Retatrutide (LY3437943) in Participants Who Have Obesity or Overweight | ClinicalTrials.gov TRIUMPH-1

Study Details | NCT05929079 | A Study of Retatrutide (LY3437943) in Participants With Type 2 Diabetes Mellitus Who Have Obesity or Overweight | ClinicalTrials.gov TRIUMPH-2

Study Details | NCT05882045 | A Study of Retatrutide (LY3437943) in Participants With Obesity and Cardiovascular Disease | ClinicalTrials.gov TRIUMPH-3

This trial may or may not make it under the 2026 umbrella(at worst it’ll be January 2027), but Lilly is nothing if not aggressive in their topline readouts. They’re comparing Tirzepatide vs Retatrutide. Let me repeat that, they’re testing their best selling drug which had over $30 billion in sales against a drug that isn’t even FDA approved yet. Why? Because retatrutide is that much better. The impact may not be as hard as we’ll have a good idea of retatrutide’s ability by the end of the year but still kudos for essentially trashing your own best selling drug by showing how much better your new drug is. 8/10.

Study Details | NCT06662383 | A Study of Retatrutide (LY3437943) Compared to Tirzepatide (LY3298176) in Adults Who Have Obesity | ClinicalTrials.gov Triumph 5

On the diabetic side we have 3 trials to discuss, they’re all named TRANSCEND, get it…transcend diabetes with this drug… eye roll Anyways, Transcend 1 will report out in the next few weeks, it’s a short 40-week trial of retatrutide in diabetics and it will again be a shock and awe result. Weight loss won’t be at a plateau but probably around 17%-19% with a 2.2-2.4% reduction in A1c. The weight loss in 40 weeks will top tirzepatide and CagriSema which needed 68 weeks to reach maximum weight loss. 9/10 only because it won’t show maximum efficacy in such a short trial.

Study Details | NCT06354660 | Effect of Retatrutide Compared With Placebo in Adult Participants With Type 2 Diabetes and Inadequate Glycemic Control With Diet and Exercise Alone (TRANSCEND-T2D-1) | ClinicalTrials.gov

Transcend 2 and 3 will be late end of the year report outs. Transcend 2 compares retatrutide to semaglutide for 80 weeks and if you’re thinking, wait, Lilly is also comparing retatrutide to tirzepatide and tirzepatide absolutely rocked semaglutide in head-to-head trials, so what’s retatrutide about to do?! Hint, it won’t be pretty for semaglutide. Yeah, this is the medical equivalent of this Simpsons meme:

RIP Semaglutide and thank you for kicking off the incretin revolution.

10/10 for Transcend 2.

Anyways.

Transcend 3 will look at patients with moderate to severe CKD (GFR of 15-45) that is uncontrolled with insulin. It’s a 52-week trial and while they don’t have renal outcomes listed, I guarantee you’ll see a huge reduction in insulin use in this trial along with some very curious renal data, which is why it also gets a 10/10 from me and leads me to our very last trial, Transcend CKD.

Study Details | NCT06260722 | Effect of Retatrutide Compared With Semaglutide in Adult Participants With Type 2 Diabetes and Inadequate Glycemic Control With Metformin With or Without SGLT2 Inhibitor (TRANSCEND-T2D-2) | ClinicalTrials.gov

Study Details | NCT06297603 | Effect of Retatrutide Compared With Placebo in Participants With Type 2 Diabetes and Moderate or Severe Renal Impairment, With Inadequate Glycemic Control on Basal Insulin, With or Without Metformin and/or SGLT2 Inhibitor (TRANSCEND-T2D-3) | ClinicalTrials.gov

Transcend CKD was completed in late 2025 but has yet to report out data. It is a phase 2 trial specifically looking deep into kidney function changes seen in earlier retatrutide trials, which included among other things, an INCREASE in GFR without signs of hyper filtration, which if this trial proves that effect would shake the very foundations of medicine and how we manage kidney disease. All signs and rumors point to this being the case with this trial. We just need the data. My personal excitement for this trial basically breaks the scale. 10,000/10. (It could also bust, but I’m going to choose positivity)

Study Details | NCT05936151 | A Study of Retatrutide (LY3437943) on Renal Function in Participants With Overweight or Obesity and Chronic Kidney Disease With or Without Type 2 Diabetes | ClinicalTrials.gov

So that’s it! A huge year for incretin science overall. The pace of drug development is rapidly accelerating but on a personal opinion, 2026 is essentially a 1 horse race. Lilly is lapping everyone with multiple drugs, broad sweeping trials looking at numerous indications and they have multiple novel drugs. If I were to include 2027 it would be even more obvious. If I’m extremely generous to Novo Nordisk it’s a 1.5 horse race as they’re quite obviously behind the 8-ball right now, however, their new CEO is doubling down on obesity and diabetes this year, so they may be able to catch up in a year or two. The pharma industry is nothing if not rapidly changing. To all the other assets I discussed, I say good luck, we know who the leader is, and they’re not slowing down their pace of development. If anything, they’re accelerating it.

The next article will probably be a discussion of one of these many trials, given we should have results soon! Stay tuned!